This tax season feels different, doesn’t it? We are more disgusted than usual as we write that check. We The People have long known that individuals were defrauding the 1,001 welfare programs. Indeed, virtually every taxpayer knows such a fraudster or two or three or . . . We The People have also long known that each federal agency skims off the top way too many of our tax dollars before those dollars have a chance to help our fellow Americans. We The People have also known that way too many bureaucrats were performing completely useless tasks, and/or tasks that hurt Americans, controlled Americans and forced Americans to do something we did not want to do. We The People also knew that few bureaucrats were performing tasks that actually helped Americans.

HOWEVER . . .

It wasn’t until Trump 47, Elon Musk and their Department of Government Efficiency went to work did We The People start to learn of the massive, enormous, stupendous, colossal, gigantic, vast, tremendous, mammoth and—I have run out of adjectives—grift which is otherwise called the federal government. Now that we know how our overlords have been spending OUR money, We The People demand, yes I said demand, that Trump’s tax cuts, which are set to expire 12/31/2025, be made permanent.

LET’S REVISIT TRUMP’S MASSIVE TAX CUTS

The Tax Cuts and Jobs Act (TCJA), a major overhaul of the tax code, was signed into law by President Donald Trump on December 22, 2017 and became effective for tax year 2018. No Democrat in either the House or the Senate voted for the bill. Democrats have always been greedy. LBJ (11/1963-01/1969) was able to double income taxes in 1968 only because Democrats owned the House & Senate.

Trump’s legislation included some of the biggest changes to the tax code in three decades (when Reagan, a Republican, lowered taxes in 1986). Constantly demanding that “you pay your fair share” without defining what “fair” is, you know that Democrats are greedier than Republicans, on average. Trump’s tax reform impacted both taxpayers and small business owners alike, particularly through tax cuts. Low-income and modest-income renters benefited the most. Most of the tax reform benefits for individuals are set to expire December 31, 2025. The law also created a single flat corporate tax rate of 21%.

The law cut corporate tax rates permanently and individual tax rates temporarily. It permanently removed the individual mandate requiring individuals to purchase health insurance, a key provision of the disastrous Obamacare, AKA, the Affordable Care Act.

How the TCJA Affected Individuals

Income Tax Rates: The law retained the seven individual income tax brackets. The top rate fell from 39.6% to 37%, while the 33% bracket dropped to 32%, the 28% bracket to 24%, the 25% bracket to 22%, and the 15% bracket to 12%. The lowest bracket remained at 10%, and the 35% was unchanged.

Standard Deduction: TCJA significantly raised the standard deduction. For tax year 2024, the standard deduction for single filers is $14,600 and $29,200 for married couples filing jointly.

Personal Exemption: The law suspended the personal exemption, which was $4,150, through 2025. It was replaced with a much higher “standard deduction” which benefited lower income Americans, especially renters, and cost high earners more taxes because it removed the high amounts they had been claiming.

Health Coverage Mandate: TCJA ended the individual mandate, a provision of the Affordable Care Act (ACA) that levied tax penalties for individuals who did not obtain health insurance coverage.

Child Tax Credit: The law raised the child tax credit to $2,000 and created a non-refundable $500 credit for non-child dependents. Qualifying children must be younger than 17 years of age. The child credit begins to phase out when adjusted gross income (AGI) exceeds $400,000 (for married couples filing jointly, not indexed to inflation). These changes expire in 2025.

Student Loans: TCJA allows 529 plans to fund K to 12 private school tuition—up to $10,000 per year, per child. Under the SECURE Act of 2019, also signed by President Trump, the benefits of 529 plans were expanded, allowing plan holders to withdraw a maximum lifetime amount of $10,000 per beneficiary penalty-free to pay down qualified student loan debt.

Retirement Savings: The law repealed the ability to recharacterize one kind of contribution as the other, that is, to retroactively designate a Roth contribution as a traditional one, or vice-versa. Since the passing of the Setting Every Community Up for Retirement Enhancement (SECURE) Act in December 2019, individuals can contribute to Individual Retirement Accounts (IRAs) past 70½. Health savings accounts (HSAs) were not affected by the law.

Mortgage Interest: TCJA limits the mortgage interest deduction for married couples filing jointly to $750,000 worth of debt, down from $1,000,000 under the old law. The change expires after 2025.

State and Local Tax: The new law capped the deduction for state and local taxes at $10,000 through 2025.

Economic Growth

Treasury Secretary Steven Mnuchin said that the Republican tax plan would spur sufficient economic growth to pay for itself and more, saying of the "Unified Framework" released by Senate, House, and Trump Administration negotiators in September 2017:

"On a static basis our plan will increase the deficit by a trillion and a half. Having said that, you have to look at the economic impact. There's $500 billion that's the difference between policy and baseline. That takes it down to a trillion dollars. And there's two trillion dollars of growth. So with our plan we actually pay down the deficit by a trillion dollars, and we think that's very fiscally responsible."

On Dec. 11, 2017, the Treasury released an analysis showing that the law will increase revenues by $1.8 trillion over 10 years. The economy experienced massive growth, unemployment was the lowest in 50 years, and workers received huge increases in wages, during the Trump Administration due, in part, to the TCJA.

Lower-Income Will Suffer When TCJA Expires

Once individual tax cuts expire after 2025, the majority of taxpayers, 53.4%, will face a tax increase: 69.7% of those in the middle quintile (40th to 60th percentile) will pay more.

The Joint Committee on Taxation estimated that the 22 million households making $20,000 to $30,000 will collectively pay 26.6% more in tax year 2026 than they would under Trump’s TCJA. The 629,000 households making over $1,000,000 will pay 1% less.

The Tax Cuts and Jobs Act (TCJA) was a major tax code overhaul signed into law by President Trump in 2017 and became effective for tax year 2018. TCJA cut taxes for shareholders and individual taxpayers alike. However, cuts for individual Americans expire in 2025, at which time the majority of taxpayers will face a significant tax increase.

Pay Your Taxes, You Slaves, Grifters Demand It

As this article goes to press, you, the tax slaves of America, have not yet come close to working off your 2025 tax burden. Yes, I am referring to THIS tax year, 2025. The average taxpayer (40.1% of Americans do not pay income taxes) works from January 1st to April…

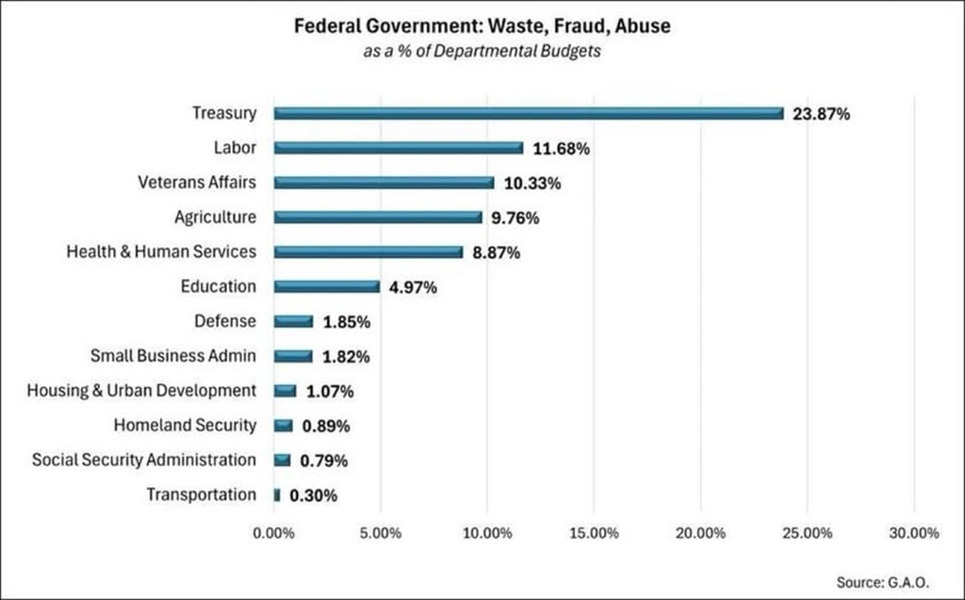

Wow! Your chart of Federal Government: Waste, Fraud, and Abuse was a shock... seeing the Treasury at the top of the list by such a wide margin... or maybe not that big of a surprise!

The blood sucking Democrat-RINO-Deep State UniParty parasites in the nation’s Capitol have been ripping off America’s taxpayers for decades. Perhaps some of them will “emigrate” to El Salvador as guests of that super max prison.