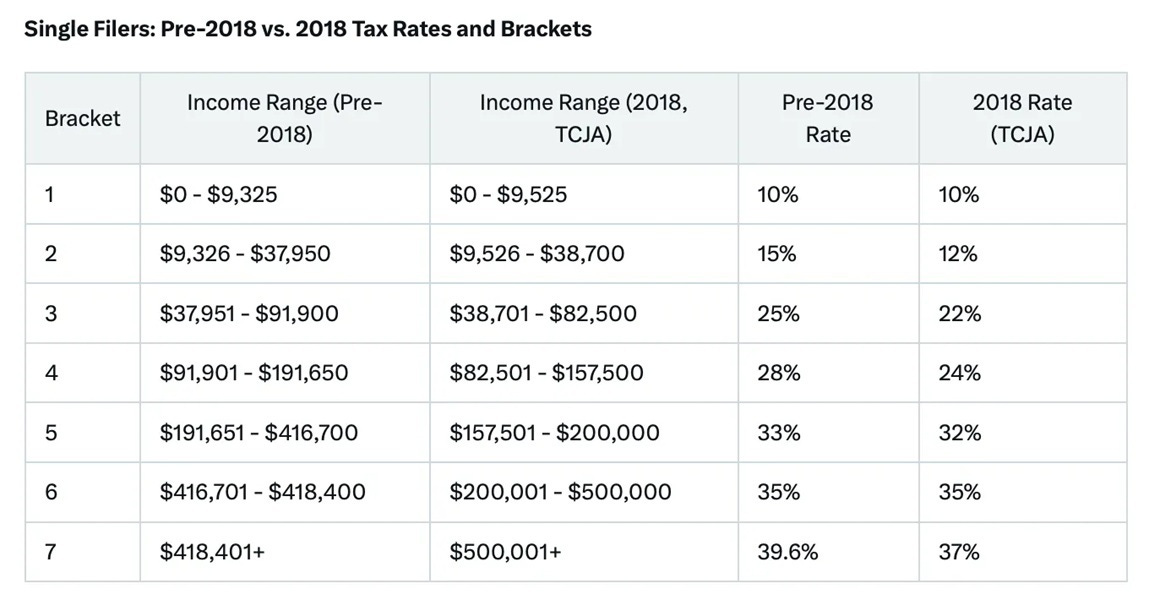

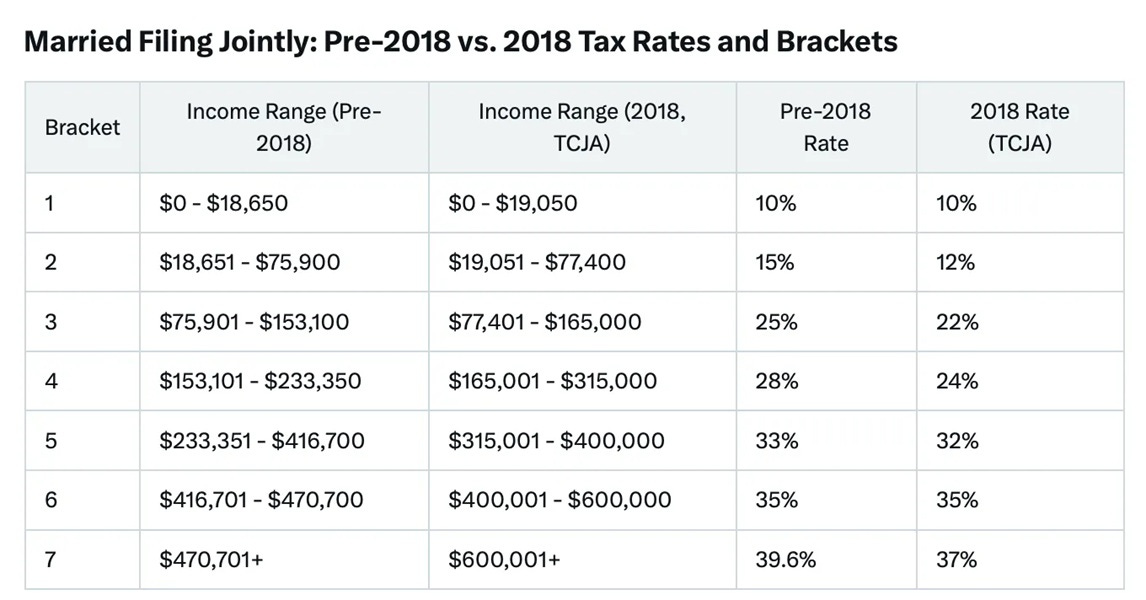

Trump 45’s Tax Cuts & Jobs Act of 2017 (TCJA) is designed to expire at the end of this year. If Trump’s One Big Beautiful Bill is not passed, in one form or another, Americans will experience the biggest tax increase in history. Moreover, if these huge tax cuts are not made permanent, the economy will tank, which is what Democrats want. Higher tax rates will hit all income brackets, and the loss of expanded deductions and credits would further strain household finances, especially families who have been struggling under Bidenomics for four years. With higher taxes, Americans will be feeding the DC grifters, not their families.

TAX RELIEF BY THE NUMBERS

Enacted in December 2017, the Trump tax cuts slashed tax rates across the board starting in 2018. As his first administration began President Trump knew cutting taxes would benefit the average American AND help the economy after 17 years of stagnation. He was right: The economy experienced massive growth, unemployment was the lowest in 50 years, and workers received huge increases in wages, during Trump 45 due, in part, to the TCJA, while 80% of taxpayers benefited from Trump’s TCJA tax cuts. Average yearly tax savings were about $2,100,^ with lower income and middle income households benefiting the most.

TCJA lowered individual income tax rates. SEE CHARTS BELOW

TCJA doubled the amount of the standard deduction, $15,000 for single filers and $30,000 for married filers.

TCJA expanded the child tax credit.

TCJA capped the state and local tax (SALT) deduction at $10,000.

TCJA reduced the corporate tax rate from 35% to 21%,a change that has already been made permanent.

Voters in swing districts currently favor renewing the Trump tax cuts 52%-36%.*

Here’s a summary of how it shakes down:

Estimated Annual Costs to You if the TCJA Trump Tax Cuts Expire

Single Person, Income $45,000:

Pay $827 more in taxes

Family, Married filing jointly, income $90,000, 2 kids:

Pays $2,065 more in taxes

Pass-Through Business Owner, Married, no kids, business income $100,000:

Pays $3,605–$5,645 more in taxes

Today, it is widely accepted that the TCJA Trump tax cuts delivered substantial tax relief, particularly for lower- and middle-income Americans, with tens of millions of filers saving thousands of dollars annually.

DemZzz want mass chaos they want everyone eating dirt and liking it.. Done ✅ with Dirty DemZz ✅💯

Dems want this and a few 🦏’s do too. In fact a few 🦏’s will vote against this too. Republicans in charge President, House, Senate?? Doesn’t appear so. They are sabotaging We The People.